Travel hacking isn’t new, it is an evolution of coupon clipping that became popular in the 1980s. You still stay organized, research deals, and leverage program rules. Some of the dangers have persisted to today as well, but the stakes are higher.

There are more pitfalls than ever, so weigh your risks against the rewards

Some people purchase gift cards as part of their travel hacking toolkit, but programs can (and have) suddenly changed without notice, leaving people with great difficulty in liquidating them.

I know a peer who had more than $5,000 stuck in a certain kind of gift card when a program changed overnight and they were unable to liquidate them at the store of choice. There were other ways to eventually use the funds, but very time consuming, and almost negating the value of the miles received.

The sheer number of programs available can also be nerve-wracking to manage.

- With what hotel chain do you want to stay?

- Do they have a co-branded credit card?

- What are the redemption restrictions? Do the points expire?

- Are Chase Ultimate Rewards points transferrable to that program to top-off for an award if I dont’ have enough?

- What do I do with orphaned / left-over points? How do I minimize this?

So, weigh your pros and cons. Perform a risk assessment. Is it worth your time to risk relying on the permanence of certain program rules? Is it worth your time to learn a new hotel program? It can be better to pay cash.

Make sure to factor in the value of time

The number of deals seems to have increased in recent years, but the average quality of those deals have decreased. For example, Amex Small Business Saturdays used to be easier to register, and had a high value of $50 per card. Now, the program requires a higher spend to achieve the cashback, which for me has negated the benefits of the program, unless I had major planned-purchases at a local small business, like a service interval at a car repair shop.

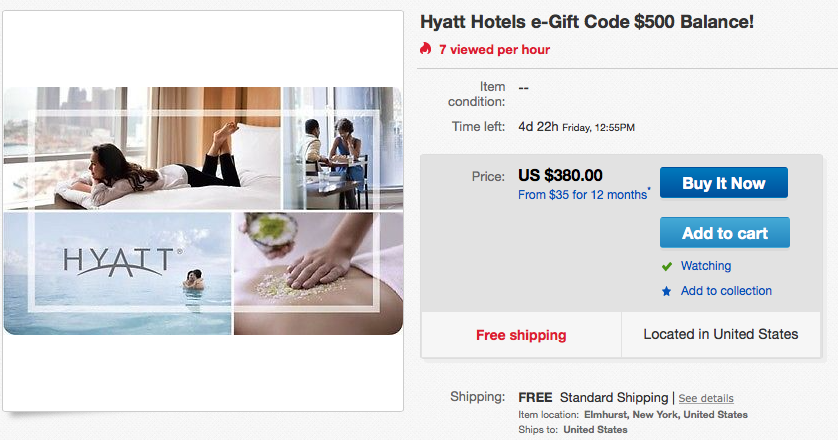

However, I leave a caveat – I bake into my travel planning workflow a step to check eBay for discounted travel credit for paid flights/hotels. I find that discounted codes from a reputable ebay dealer can be a great value for the time in searching and purchasing. Below is an example of the type of deal I’ve said ‘yes’ to, since the 20%+ savings scale at the larger denomination. I saved $120 instantly.

Certain purchases and strategies don’t scale down

Gift card discounts on sites like eBay and Gift Card Granny are lucrative, but only in larger denominations. They don’t scale down.

What do we do? Only go through the trouble for major purchases (thousands of dollars) otherwise, the savings is likely, not worth your time.

Recently, I wasted time buying a $25 home depot gift card for $20. I fell into this pitfall out of a habit of searching for good deals and I typically don’t purchase such low denominations. I forgot that discounts don’t scale down. The overhead of searching, setting up a new website account (and having new accounts/logins to keep track of), purchasing and waiting for the GC, was a headache and not worth the time for $5 of savings.

The discount percentage is 20%, so if I am buying a refrigerator or a washer and dryer, I can save $200-400, which may be worth my time

And if you have a stockpile of gift cards that you don’t want to use, read this post on selling unwanted gift cards.

Don’t buy large gift cards at a discount for ‘future purchases’

Maybe some of you buy things regularly from one vendor. Some may say, “Why don’t I just buy a large GC amount and then remember to use the card for those purchases?” I don’t think that’s a good idea for the following reasons.

- In a just-in-time economy, I don’t want sunk costs (lock you into that vendor) that depreciate. Double whammy.

- There could be a better deal at the time of a major purchase.

- Why waste the mind space of remembering to use the card? Or worst, risk losing the value by not remembering to use it.

- You may not have the physical card/code with you the next time you need it.

- The psychological effects of having a GC in inventory is devastating. Having that amount locked in makes me want to liquidate it and free me from artificial loyalty.

The same applies to miles. Don’t accrue a large inventory of miles from any one program without a clear redemption plan. Programs can change at any moment and your miles are bound to devalue. I usually only accrue enough miles for the next 18 months worth of trips. I stop signing up for new credit card offers until I have more planned trips.

Earn and burn! You’ll thank me later.

Takeaway on how to avoid the pitfalls of travel hacking

- Weigh your risks versus rewards when investing in reward programs or new techniques.

- Factor in your time.

- Purchase discounted gift cards only for major purchases.

- Stick with a ‘just-in-time’ mentality, whether it’s for GCs or miles.

What are additional ways that you avoid the pitfalls of travel hacking?