In addition to miles and points programs, I’m a big fan of cash back cards. I include cash back cards like the Costco Amex and Citi DoubleCash in my inventory to complete my earning strategy.

Unless I can get category bonuses that exceed 2% cash back equivalent in value, I normally stick with a cash back card. When I travel, I am not afraid to spend the money where it matters because I’ve put a system in place to maximize the return on my normal spend. I think this hybrid strategy effectively leverages the best of both worlds.

However, some cash back cards come with annual fees and I must be able to justify the annual fees.

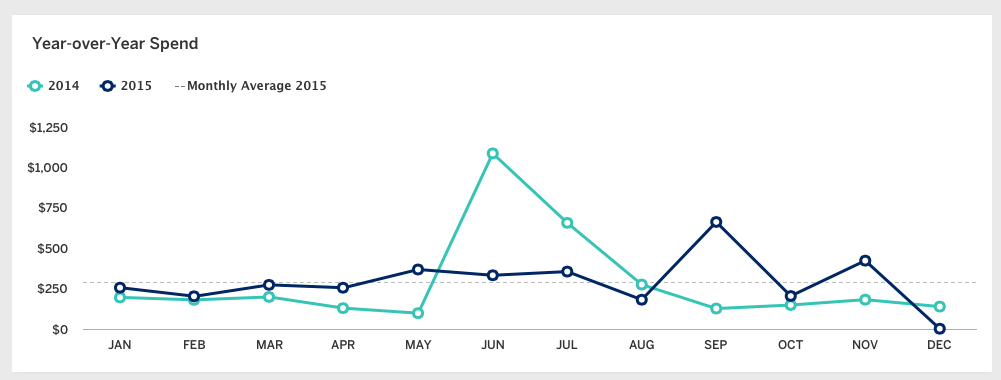

Today, I evaluated my 2015 cash back with the Costco card and found some surprising trends.

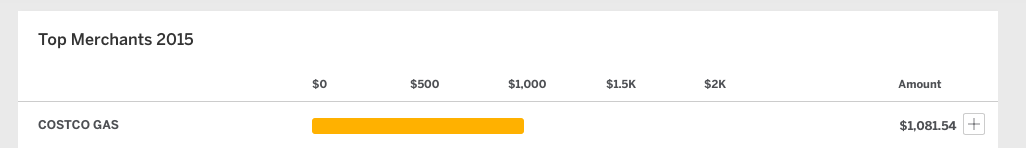

- I spend about $1k per year on gas, which is much lower than I thought (I mostly get gas at a nearby Costco, and I fill up for my wife as well).

- My major Costco purchases in 2014 were in the summer time while in 2015 were evenly spread out.

I want to focus the attention on the gas because that’s the single largest cash back category for this card at 3%. Getting $30 back only covers 60% of the annual fee on a Costco membership ($50). How do I maximize the value of this card (why am I paying the annual fee)?

I realized that I must think of the card this way: access to higher values for the products carried by Costco. Costco products are not the cheapest products, but on a per unit basis compared to competitor stores, I often save 2-4%. I spent about $1k on products last year, so my savings is $20-40.

On gas, specifically, the membership grants access to much cheaper top-tier gas. Costco gas has consistently been 25-35 cents below market price per gallon. The average price for gas last year was about $2.50 per gallon and the savings were equivalent to roughly 15%. That means I saved about $150.

So if I add up the value of the products and gas, the membership has more than paid for itself.

I can think of the cash back roughly paying for the cost of membership, while the net benefit is in the access to lower prices, especially on gas.

How have you justified the expense/annual fee on your credit cards?