Many of my readers have multiple credit cards, but they don’t always know which is the best card to use for a particular purchase. Follow the below steps to not only maximize your point earnings, but also optimize your credit card benefits.

Note that this post is not about what card you keep in your wallet because bloated wallets are a thing of the past. Apple/Samsung Pay and digital wallets allow you to ‘carry’ most of your cards with you, so the question is what card to use where?

- First focus on meeting minimum spend requirements.

- Second, look at what time-sensitive promotions may exist.

- Third, use portals when shopping online.

- Fourth, use the card that gives the largest bonus for the type of purchase you are making.

- Finally, use a flat cash back card for all other purchases.

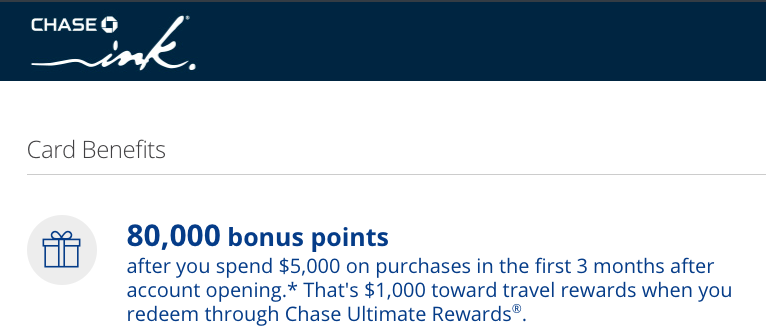

1. New Credit Cards: Minimum Spend Requirement

Generally, I always put ALL my purchases on my most recently acquired card. This is because the card likely has a threshold to meet in order to earn bonus points. For example, “spend $2,000 in 90 days to earn X amount of bonus points.” This is the easiest rule to follow.

2. Bonuses: Quarterly or Limited-Term Promotions

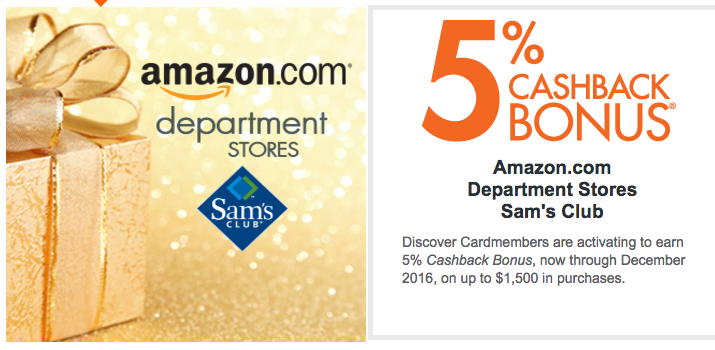

After I meet my minimum spend requirements, I look at what promotions are available. For example, if you have a Chase Freedom card, you can earn 5% cash back (or more if leveraging point transfers to premium Chase cards). The category of spend rotates on a quarterly basis; this quarter the promotion is on Grocery Stores, ChasePay and Paypal purchases, so I know to use my Chase Freedom card when making those type of purchases.

Other quarter promotions have included department stores, wholesale clubs, drug stores, Amazon, and others. So you basically get 5%+ cash back at stores like Macy’s, Costco, and Walgreens (both in-person and online). They usually rotate annually, so if you missed this year’s Q2 promotion, you’ll likely get another chance next year.

I highly recommend getting this card if you don’t have one already. Then read my previous post on maximizing points earned from the Freedom by redeeming with your Chase Sapphire Reserve.

Beside quarterly bonuses, some cards have limited term promotions. The Discover It card has similar quarterly promotions as the Chase Freedom, but also doubles all your cashback earned in your first cardmember year. That means you effectively earn 10% on all promotional purchases that year, which is about as good as it gets. Past bonus categories have even included Amazon.

3. When Shopping Online, Use Portals.

I highly recommend Ebates. In fact, sign up using this link to get $10 upon your first purchase.

Let’s say you want to buy something at Macy’s. Don’t go to Macy’s.com directly. Instead, go to Ebates.com and search for ‘Macy’s’. Once you click through their link, you will be earning straight cash back for all of your purchases at Macy’s.com. I’ve earned up to 20% cashback on purchases, but even the regular cashback of 2-4% is extra money in your pocket.

You get a rebate check (or Paypal transfer) at the end of each quarter. I’ve earned hundreds of dollars in rebates from Ebates since 2009 and I can attest to their legitimacy.

Best of all, this cashback stacks on top of the cashback you earn using your credit card!

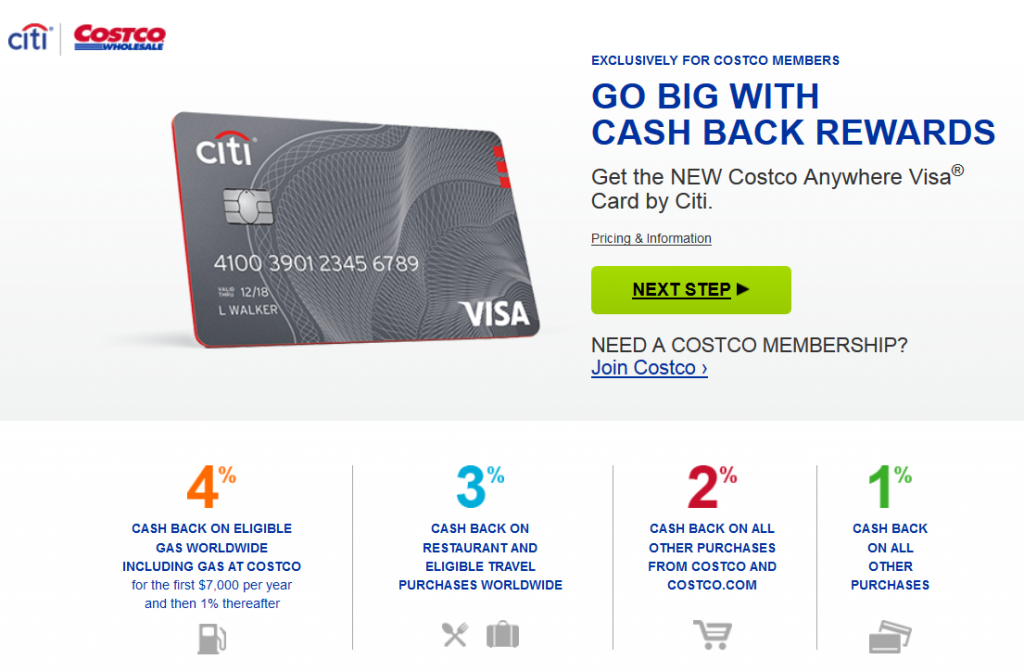

4. Card-specific Bonuses

Some cards, like the Costco Anywhere Visa card, earns 3% cash back on travel purchases and 4% cash back on gas. After a while, it will become second nature to pull out this card every time you fill up on gas or need to make a hotel purchase.

5. Finally, Use a Flat Cash Back Card

For all other purchases that don’t fall within the above categories, I recommend the Citi DoubleCash card for a flat 2% cashback on everything.

Summary

- First focus on meeting minimum spend requirements.

- Second, look at what time-sensitive promotions may exist.

- Third, use portals when shopping online.

- Fourth, use the card that gives the largest bonus for the type of purchase you are making.

- Finally, use a flat cash back card for all other purchases.

Follow this workflow (or modify this workflow to meet your spending pattern), and you will be on your way to maximizing your point earnings. Then you will have a boat-load of points to redeem for free travel!

Clear and practical !

Thanks, Steve! Glad to be helpful.